Investing in real estate has long been considered a stable, profitable means of building wealth. With the right approach, it’s a financial avenue that allows you to generate both short-term cash flow and long-term appreciation. But the world of real estate can also be complex, requiring research, strategy, and careful financial planning. This guide will walk you through everything you need to know about real estate investment—from understanding the basics to exploring real-life success stories.

1. Problem: The Challenges of Building Wealth through Real Estate

Building wealth isn’t easy, and real estate investment can seem overwhelming. With high entry costs, ongoing expenses, and risks like property devaluation or vacancy periods, many people are hesitant to dive in. Common obstacles include:

- Capital Requirement: You need a large initial investment for down payments, closing costs, and repairs.

- Market Volatility: Real estate markets fluctuate, and the value of property can decrease.

- Maintenance and Management Costs: Owning property comes with ongoing expenses like maintenance, taxes, and insurance.

Given these challenges, it’s easy to feel intimidated or wonder if real estate is the right path. But with strategic planning, real estate can actually be one of the most rewarding investments you can make.

2. Agitate: What Happens When You Don’t Invest in Real Estate?

Without investing in real estate, you could be missing out on significant financial growth. Unlike many investment vehicles, real estate offers tangible, inflation-resistant assets. Here’s what you risk:

- Lost Passive Income: Rental properties generate monthly cash flow. By not investing, you miss this steady income stream.

- Missed Tax Benefits: Real estate comes with multiple tax advantages, from property depreciation to deductions for expenses.

- Limited Wealth Growth: Real estate typically appreciates over time, offering a hedge against inflation. Failing to invest might mean slower wealth accumulation.

One real-life example is that of Robert Johnson, a 45-year-old financial planner who initially overlooked real estate. After focusing solely on stocks, he saw moderate growth but later admitted missing the opportunity to diversify with real estate, which could have strengthened his portfolio during economic downturns.

3. Solution: How to Get Started in Real Estate Investment

If you’re ready to overcome the challenges and reap the benefits of real estate investment, let’s dive into some proven strategies.

Step 1: Identify Your Investment Goals

Every investor has unique goals. Some look for passive income; others want long-term growth. Here’s a look at three main types of real estate investments and their typical returns:

- Residential Rental Properties: These properties offer monthly cash flow and an annual return rate of around 8–12%.

- Commercial Real Estate: Commercial properties are leased to businesses and tend to have a higher return rate of 10–15%.

- Real Estate Investment Trusts (REITs): REITs provide a way to invest in real estate without buying physical property, with an average annual return of about 10.5%.

Step 2: Understand Market Research and Analysis

Knowing how to analyze the market is critical. The key is to look for cities or neighborhoods with economic growth, good infrastructure, and increasing property values. Here’s how you can analyze the market effectively:

- Job Market Stability: Areas with a growing job market have higher demand for rental properties.

- Rental Yield Calculation: Rental yield is calculated by dividing annual rental income by property price. A yield above 5% is generally considered profitable.

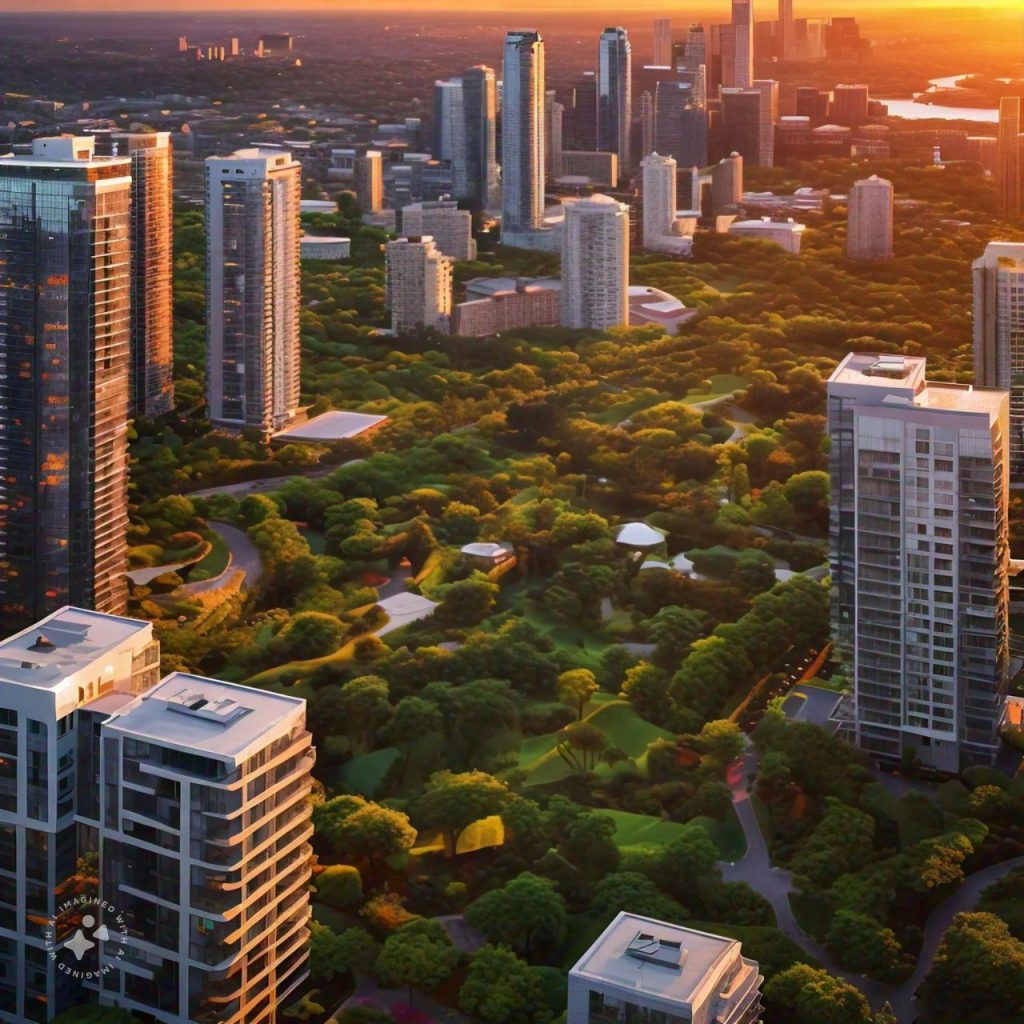

For example, investor Sarah Li researched Austin, Texas, in 2018 and found it had both a strong job market and high rental demand. She bought a property there, which has appreciated by 30% and generates a steady cash flow, thanks to her diligent market analysis.

Step 3: Financing Your Investment

Most investors use leverage, or borrowed funds, to maximize returns. But it’s essential to be strategic. Consider:

- Down Payment Requirements: Aim for a minimum of 20% to avoid private mortgage insurance (PMI).

- Interest Rates: Secure the lowest possible rate to reduce monthly payments and increase your profits.

- Loan Types: Compare fixed-rate mortgages and adjustable-rate mortgages (ARMs) to find what fits your budget and risk tolerance.

A case in point is James Walker, who used a fixed-rate mortgage at 4% to buy a multi-family home in Denver. By keeping his interest rate low, he managed to generate a cash-on-cash return of over 15% annually.

Step 4: Hands-On Management vs. Property Management Companies

Once you’ve acquired property, you must decide whether to manage it yourself or hire a property management company.

- DIY Management: If you’re handy and live near the property, DIY can save costs but requires time.

- Property Management Company: Costs around 8–12% of monthly rent but frees you from maintenance, tenant relations, and repairs.

Let’s take the case of Mark and Lisa Taylor, a couple who invested in a rental property in Boston. Initially, they managed the property themselves, but as their portfolio grew, they hired a management company. This freed up time and allowed them to scale up their investments.

Real Estate Investment Strategies

1. Buy-and-Hold Strategy

In the buy-and-hold approach, you purchase a property and rent it out while waiting for it to appreciate in value. This strategy is popular due to the dual benefit of monthly rental income and long-term appreciation.

- Best For: Investors seeking long-term growth.

- Example: Mike Harris bought a $200,000 home in Atlanta in 2015. Today, the property is valued at $300,000, and he has collected $75,000 in rental income over the years.

2. House Hacking

House hacking involves purchasing a multi-family property, living in one unit, and renting out the others. This can significantly reduce your housing costs and provide passive income.

- Best For: Beginners looking to enter the market affordably.

- Example: Jenny Kim bought a duplex in Philadelphia, living in one half and renting the other. Her tenant’s rent covers her mortgage, allowing her to save for future investments.

3. BRRRR Strategy: Buy, Rehab, Rent, Refinance, Repeat

The BRRRR method is effective for properties that need improvements. After purchasing and rehabbing a property, you rent it out, refinance to pull out your investment, and then repeat the process.

- Best For: Experienced investors willing to take on renovation challenges.

- Example: Real estate investor Chris Nguyen used BRRRR on a rundown property in Detroit. After renovating, he refinanced to pull out his initial investment, then reinvested in a second property.

Common Pitfalls in Real Estate Investment and How to Avoid Them

- Over-leveraging: Borrowing more than you can manage can lead to financial strain.

- Ignoring Maintenance Costs: Underestimating repairs can eat into profits.

- Not Researching Tenants Properly: Tenant issues can lead to lost rent and property damage.

Conclusion: Ready to Make Your First Real Estate Investment?

Real estate investing offers a pathway to financial independence and wealth building. By understanding the different strategies and doing thorough research, you can mitigate risks and increase your chances of success. Whether you choose to buy and hold, try house hacking, or experiment with the BRRRR method, real estate can be a highly rewarding investment if approached wisely.

Frequently Asked Questions (FAQs)

1. Is real estate a good investment in 2024?

Real estate remains a strong investment option in 2024 due to continued demand, a shortage of housing supply in many areas, and relatively stable mortgage rates. However, market research is crucial to avoid overpaying or investing in areas with stagnant growth.

2. How much capital is required to start investing in real estate?

Generally, a down payment of 20% is advisable. For example, if you’re buying a $250,000 property, you would need at least $50,000 for a down payment. Additional costs include closing costs, maintenance, and potential renovations.

3. What are some real estate investment tax benefits?

Real estate investors can benefit from deductions on property taxes, mortgage interest, property management fees, and depreciation. These deductions can offset rental income and reduce taxable income.

4. Should I invest in residential or commercial real estate?

Both options have their benefits. Residential properties generally have more predictable cash flow, while commercial properties often yield higher returns. Evaluate your risk tolerance and financial goals to determine which type aligns with your strategy.

5. What’s the difference between passive and active real estate investing?

Passive real estate investing involves limited involvement, like REITs or crowdfunded platforms. Active investing requires hands-on management, like buying rental properties. Passive investing suits those seeking lower time commitments, while active investing can offer higher returns with more effort.